Exactly what do I actually do to change my personal probability of getting an effective home loan?

After a while, there can be alot more loan providers prepared to consider carefully your case. Eg, if perhaps you were discharged as much as four or five years ago, along with good credit score since then you can also have the ability to qualify for a mortgage all the way to ninety% LTV like any informal candidates. You can also gain access to simple interest rates and you will borrowing from the bank can cost you. By contrast, if you were released less than 24 months in the past, some think it’s difficult to be eligible for over 75% LTV along with somewhat elevated overall borrowing from the bank will set you back.

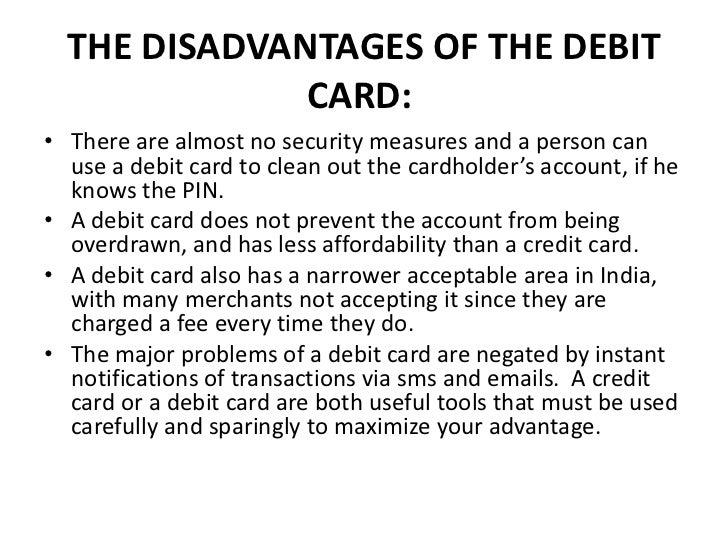

The following desk will bring a quick, however, by no means definitive report about the calculate odds of qualifying to have a home loan according to how much time you’re released regarding case of bankruptcy:

At exactly the same time, dealing with a broker might help manage your credit score of the damage because of submitting several apps

Not one for the guidance regarding table is going to be pulled literally payday loan New Hartford Center as there are other variables that along with play good part inside the determining their eligibility if not. Usually from flash but your odds of being qualified expands after a while since do the possibilities of accessing a competitive bargain.

For additional info on eligibility or even talk about the situation for the greater detail, get in touch with a member of the team on United kingdom Assets Financing when.

not has just you declare themselves bankrupt discover far can be done to increase your chances of being qualified to have a mortgage. The most important and active of which is actually:

The crucial thing that you experienced where you’re when it comes of the credit rating and you may comprehend the significance of your own borrowing from the bank get. When your credit score is not an excellent, it might stand-in just how people qualifying having a beneficial financial. Repairing credit score wreck is not something that you perform right-away, but it is something you should start trying eliminate since rapidly you could.

Large deposits normally open the entranceway to help you a broader selection of loan providers and much more aggressive home loan purchases. On the other hand, you are and far more apt to be felt qualified into the the initial lay while happy and able to bring a considerable put. This might imply being required to hold off and you may cut stretched before applying to have home financing however it could well be beneficial.

Rather than addressing loan providers actually it is best to contact an independent broker instance United kingdom Possessions Money. A broker should have the fresh associations and can let evaluate your qualification if not having private lenders before you apply.

If you have questions or concerns concerning your credit score otherwise qualification getting home financing, contact United kingdom Assets Fund when possibly on line or of the phone, otherwise we could see face-to-face.

What is the Hunters Statement?

If perhaps you were released away from bankruptcy proceeding more half dozen in years past and then have a credit score, just be in a position where you are able to apply at most lenders regarding normal method. The application may violation the fresh bank’s very first inspections, but may end up being denied at the a later stage. In such a circumstance, you have fell prey toward Hunters Report.

And it’s really an anti-fraud study revealing program, this new Candidates Statement is even a databases of any person that has actually been proclaimed bankrupt in the uk. This can include individuals who was indeed released more than six years back, and then the historical past of bankruptcy is technically not getting associated. Unfortunately, most main-stream loan providers consistently request the latest Candidates Statement as a means out of recognizing otherwise rejecting mortgage apps. This means that though everything else is actually acquisition, you will be rejected because of an historical case of bankruptcy on your file.