If you are planning to pay bucks, you should establish there is the finance which have a financial report

A good HUD house is a single so you can four-equipment quarters obtained within the a federal Casing Management (FHA) financial foreclosure. Brand new U. The brand new management business obtains the house against vandalism, comes with the assets examined and you may appraised, after that sets it to possess putting in a bid. On top of that, there may be debts such as property income tax outstanding otherwise utility bills that government organization needs to spend until the property is also end up being offered.

HUD belongings can be located at the 50 % of record rate which have as little as $100 off making use of their Good neighbor Across the street program. Police, pre-preschool thanks to twelfth degrees teachers, firefighters and you may crisis scientific mechanics is be eligible for this method since a lot of time while they invest in staying in our home to have in the least three years.

HUD house was listed on line; you could remark services in your area right after which get in touch with a great buyer’s representative who’ll help you through the processes. You might check always the house before distribution a quote, however you may well not enter into a property without your own agent/representative for any reason just before closure. Brokers and you will/or agents must be to the premises whenever home inspections, appraisals otherwise qualifications are now being did.

Of numerous qualities are just designed for what is called the « concern period » in order to consumers that will use them since top homes. If the zero appropriate offers have been in during the consideration several months, bidding was opened up to all the. (The latest time this occurs are listed on the house or property suggestions.) You’ll want a mortgage recognition letter or prequalification letter out of a lender before you could fill out a quote. It could take sometime to close the offer — if you wish to be in a house in this two months, an effective HUD house is probably not to you.

HUD property are sold « as-is actually, » without fixes are done one which just close on your property. HUD’s administration organization, MCB, is clear: » HUD does not ensure the reputation of every assets, FHA-insurable or not, nor when it matches regional rules otherwise zoning conditions. Buyers was informed that there may be code and/otherwise zoning violations during these properties and this ‘s the obligations of your own customer to recognize these violations. » This basically means, client beware.

S. Department regarding Houses and you will Metropolitan Invention (HUD) reimburses the lending company because of its losses into the property foreclosure, requires the property and you can turns it off to an administration organization on the market

In the end, some homes commonly qualified to receive FHA financing, as the earlier in the day home loan into property are an enthusiastic FHA financing. Usually do not quote into those people if you plan with the playing with a keen FHA loan.

Uninsurable belongings always want extensive repair and may be purchased which have old-fashioned financing otherwise cash

The agent submits a quote for you. HUD pays closing costs all the way to 3% of one’s purchase price, also a home loan origination commission as much as step one%, and a residential property broker’s percentage. not, such expenditures be removed the top when the government business evaluates the estimates. Successful estimates need to fulfill at least endurance while having produce this new large web to help you HUD. The fresh new winning bidder gets provisional anticipate at the mercy of bill of all the called for documents.

Once a bid was approved, exclusive Conversion process Bargain Plan need to be submitted within this 2 days or you buy are deceased. Earnest currency should be paid within this 72 period away from acknowledgment regarding advice from the administration team. Effective bidders have to indicate the sort of resource they shall be using and that are into financing — any changes have to be adopted which have addenda otherwise the deal are terminated.

When your bid is accepted https://paydayloancolorado.net/north-washington/, you could consult copies of one’s assessment and all inspections out of the management business. If there’s a property owners organization, its transfer charges and you can any a great expense must be approved by the administration business which can do a put off and you may include weeks into escrow. This is your a house agent’s job add fifteen-time extensions as required to help keep your purchase heading. Inability to do this will cost you your own earnest currency and you can get package canceled.

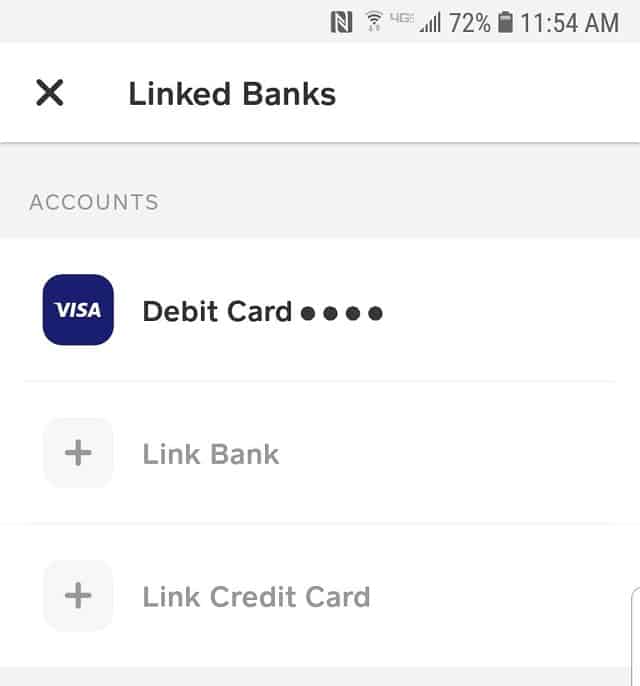

You simply can’t suppose a mortgage once you get a good HUD household. You ought to obtain money or spend bucks. Homes considered insurable might be funded that have FHA finance, and those requiring certain repair is found that have FHA 203(b) having fix escrow otherwise rehab 203(k) mortgage loans. Recall new extended big date it entails to close for the these types of purchases whenever securing on your home loan speed. Anticipate new escrow for taking from forty-five -two months.