How to Be eligible for a bad credit Mortgage

Being qualified getting home financing that have poor credit are very different dependant on your credit rating, your own work status, and if or not you’ve got got a bankruptcy proceeding otherwise a foreclosure within the past a couple of years. Here you will find the very first certificates to own a less than perfect credit financial:

If you don’t have enough time to improve their credit scores, following we’re going to show the way to pick a less than perfect credit financial today

- Credit rating A minimal credit score deductible was 500

- Deposit Minimal down payment would-be step three.5%-10%. Which deposit could well be to own around people whether you’re self-employed or you are good W2 wage earning appearing getting a less than perfect credit FHA loan. If you had a current personal bankruptcy otherwise foreclosures, your minimum down payment would-be 25%.

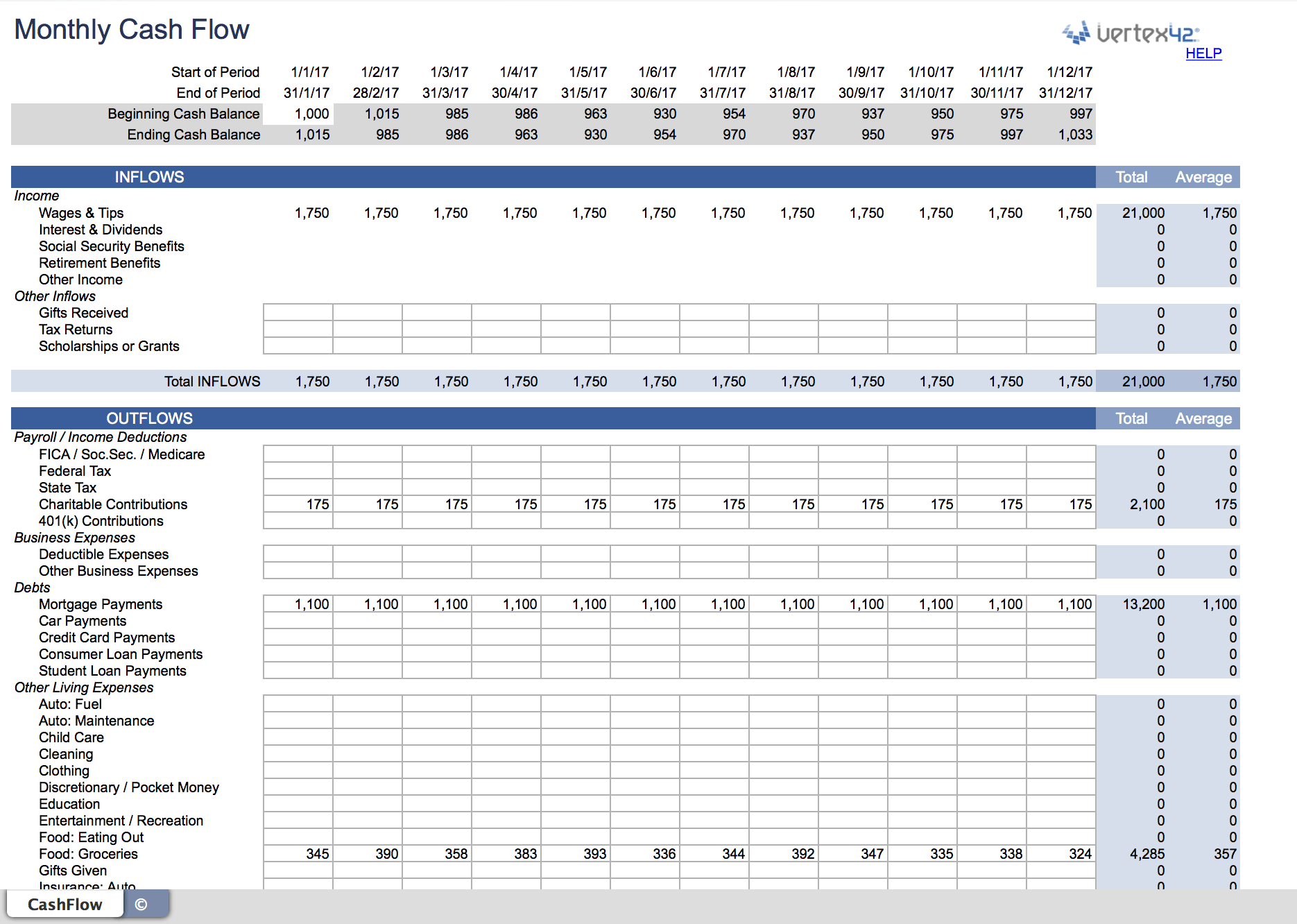

- Income Requirement W2 wage earners should promote their past 30 days shell out stubs as well as your W2s and taxation statements. Whenever you are one-man shop and cannot file your earnings, then you’ll definitely have to bring 12 months financial comments.

- Financial Statements To possess a W2 salary earner, attempt to give at least 8 weeks financial statements. Having self-employed somebody, you’ll need one year lender statements. Specific lenders may require a lot more dependant on the potency of their application.

Compensating Facts To own a poor credit Mortgage

Here are a few of compensating issues that have enjoy of trying to qualify for a less than perfect credit financial. The greater number of contain into the financial software, new healthier a credit card applicatoin it could be and browsing become approved.

Unless you have enough time to evolve their fico scores, upcoming we shall express how to come across a poor credit financial right now

- Huge Downpayment This will help to to reduce the risk to the poor credit loan providers. It shows a lot more of a connection on your part and provides a back-up in the eventuality of a foreclosures. When your poor credit mortgage system you are searching for requires only ten% down nevertheless can set-out twenty five%, up coming that’s a massive positive for you.

- High Income Stream Large earnings helps as it informs the lending company that even in the event the fico scores is crappy, you do have the bucks to make the payments. One of the key elements when underwriting that loan is actually determining an excellent borrower’s capacity to shell out so this is essential. If you find yourself self-employed which have poor credit therefore dont completely document your revenue, then you certainly is to discover mentioned money money .

- Low Obligations to Money Ratios Because of this their monthly premiums (all costs on your own credit report + your proposed mortgage payments) split into your disgusting monthly income is lower than 40%. A number of the poor credit loan providers will allow your own rates so you can become all the way to 50% 56.9%. When you yourself have poor credit along with your loans ratios is higher, you might nevertheless get home financing.

- Bucks Reserves Immediately following their advance payment and you can settlement costs, more weeks of money reserves you’ve got the ideal their opportunities to get mortgage approved. With the knowledge that you may have at least 6 months from supplies try a confident compensating grounds. Based on Dave Ramsey, your reserves should be far greater than half a year because part of a solution to reach monetary liberty. When less than perfect credit lenders check your loan application, they’re going to use supplies as among the compensating products as it helps to minimize their risk.

- Steady Employment History Involved in a comparable spot for extended is yet another good thing to help you bad credit mortgage brokers. On the other hand, if this turns out you are usually moving from one work to another or you has actually attacks out of jobless, after that this is difficulty. You are going to always you want a minimum of a two 12 months how to get loan in Pennington really works background in a choice of employment or a couple of years in your own business. However, you can nevertheless become approved if you altered services within the last 12 months.