Different factors know if an individual may be eligible for a great Va mortgage

Pros and cons away from Va Funds

The us Service regarding Veterans Situations ‘s the guarantor to possess all Va mortgages. The Virtual assistant mortgage may be used because of the energetic-responsibility people in this new army, experts, and those who possess offered in a choice of the newest protect or even the supplies. More 20 mil pros have tried this program while the 1944 so you’re able to get property. Throughout the blog post below we’re going to explain the pros and you may cons of one’s Virtual assistant financing.

Just how a good Virtual assistant Home loan Performs

Even though Va funds is actually guaranteed, the borrowed funds cannot been right from brand new Va workplace. To make anything simpler and a lot more widely accessible, The newest Va authorizes financial businesses throughout the world provide the Va financial according to sort of laws. As long as enterprises follow the laws and regulations, the organization might possibly be reimbursed because of the Va when your debtor ends up and also make money on the mortgage.

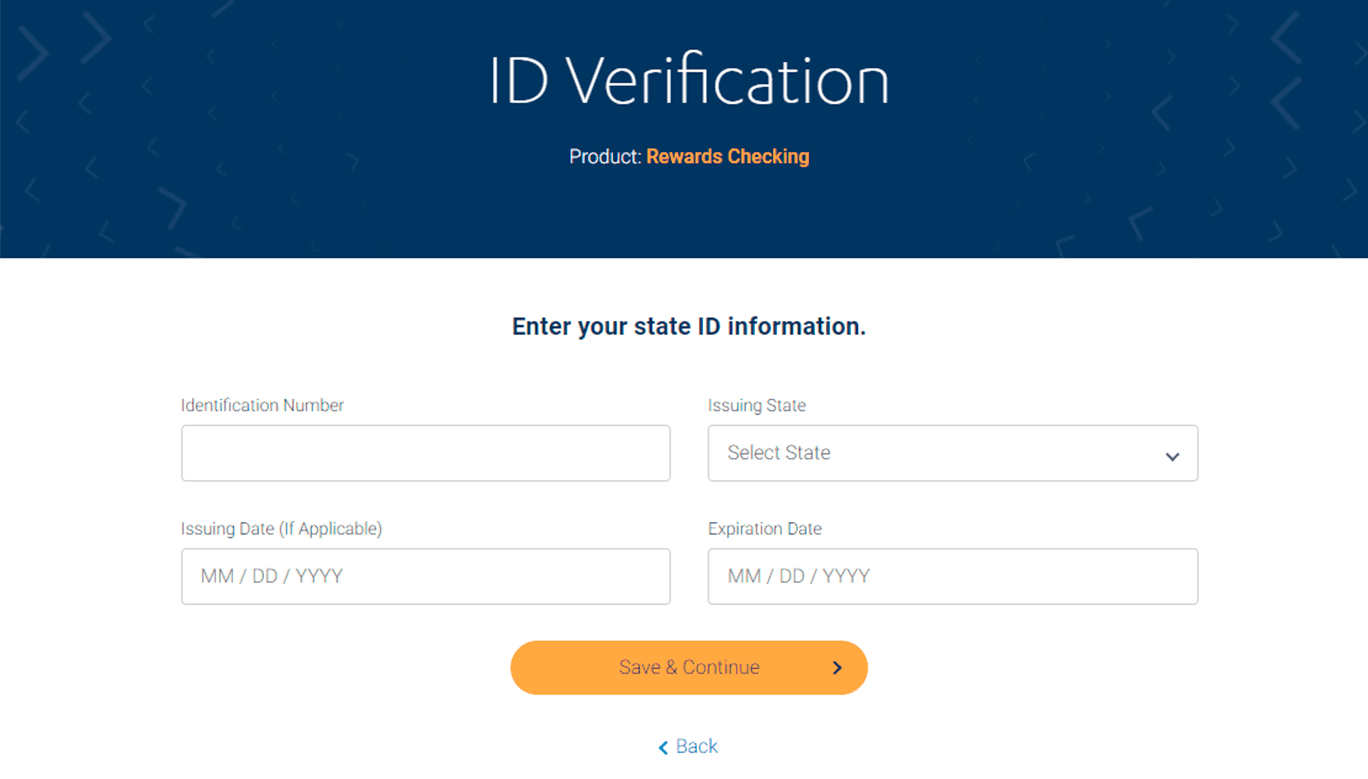

Throughout the most rudimentary out of conditions, a debtor need certainly to get the COE (Certification away from Eligibility) basic to try to get an effective Virtual assistant mortgage. Extremely home loan businesses otherwise loan officers can assist pros which have delivering a duplicate of one’s COE. A debtor need to match the requirements of just one of one’s pursuing the issues getting qualified to receive a great Va COE:

- 665 Shares

-

- You have finished your own service on the army, therefore meet up with the minimal length of services put from the Virtual assistant (ninety days in the event that served during the conflict, 181 weeks if the supported through the tranquility)

- You are already serving on the military and now have complete an excellent minimum of half a year out-of services

- Offered a minimum of 6 ages either in the brand new Armed forces Reserves and/or National Shield

- Thriving partner away from a veteran which sometimes perished throughout service or died given that a direct result of an accident acquired throughout solution.

If one drops on one of those categories possesses a sufficient amount of income to title loan Massachusetts pay for the current personal debt along towards family payment, also a decent credit history, then the people should be able to qualify for this new Virtual assistant mortgage.

Experts from Va Funds

Here you will find the most typical benefits of an excellent Virtual assistant financing one succeed such a popular selection for buying a home.

Provided the new price of the home is equivalent to otherwise below the newest residence’s appraised value, this new Va loan program will allow individuals to invest in 100% of your own speed. An enthusiastic FHA mortgage will need good step 3.5% advance payment and you can a conventional loan will require a beneficial 5% downpayment more often than not. Towards the a cost of $200,000, a beneficial Virtual assistant financing can save the borrower thousands of dollars within the amount of time off pick.

Overall, it is more straightforward to qualify for an effective Va mortgage than simply a antique home loan. Even though it is true that the fresh Va workplace doesn’t always have people minimal fico scores stated inside their advice, all the Va loan providers have a tendency to enforce some kind of credit rating requisite. This is certainly called a mortgage overlay while the lender adds so it requirement to reduce their risk in the lending the money.

With that said, it’s quite common for folks who have knowledgeable particular financial struggles in the past to acquire recognized with a beneficial Virtual assistant financial when they features lso are-built its credit.

Most lenders provides an optimum count that they are willing in order to loan to your a house. It restrict varies according to the official and you will condition of the property’s venue. Virtual assistant funds typically will vary throughout the simple fact that there can be zero set limit because of their funds.