That isn’t a good reason to help you refinance their mortgage?

Determining in case it is worth it so you’re able to refinance a home loan try mostly subjective and you may depends on individual economic items. Although not, a typical guideline is that it may be well worth offered when you can decrease your interest from the at the least 1% in order to dos%. Such as for instance a reduction could cause high deals along the life of your own financing.

In addition, refinancing is a wise circulate if you plan to stay in your home to possess way too much big date, and thus letting you recoup the expense involved in the refinancing techniques. It might additionally be worth considering if you’d like to button away from an adjustable-speed to a fixed-rate mortgage for more predictability on your own money or https://elitecashadvance.com/installment-loans-sd/dallas/ if you must utilize the residence’s security.

However, it is imperative to reason behind closing costs, relevant penalties, and impacts in your full economic wants and you can plans. Constantly request an economic mentor otherwise your own lender to make an advised decision.

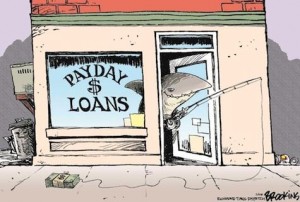

Refinancing your own financial to the best intent behind investing unstable or higher-risk assets tends to be wii reason. Although it was appealing to help you utilize the residence’s guarantee to fund such investment, you should remember that you reside equity for your mortgage. Consequently in the event the opportunities cannot dish out as expected and you are clearly struggling to build your mortgage payments, you could potentially remove your residence.

Moreover, the expenses of refinancing, such settlement costs and prospective penalties to have early payment regarding your current mortgage, you’ll after that aggravate economic losses if the expenditures usually do not give the new expected returns. Therefore, it is imperative to carefully gauge the threats and demand a economic advisor before deciding so you’re able to refinance your own mortgage to own resource intentions.

Do refinancing damage credit?

Refinancing their mortgage may have a short-term effect on their borrowing get. When you make an application for an excellent re-finance, the lending company tends to make a difficult query on your own credit report so you can evaluate the creditworthiness, which can produce a little, short term dip on the rating. Additionally, refinancing financing mode taking up another type of financing and you may closing a vintage you to definitely. So it changes the typical age your credit lines, that also apply at your credit rating.

But not, this type of affects are relatively minor and you may short-lived, and you can consistently and then make your new mortgage repayments on time should help your credit score recover and you may probably boost along side long lasting. It is essential to observe that everyone’s borrowing from the bank profile is exclusive, and so the impact from refinancing on the credit rating may vary.

Could it be hard to get recognized for a great refinance?

Taking acknowledged for a good re-finance is not fundamentally hard, but it does rely on many items, like your credit score, money, a position condition, debt-to-earnings proportion, the worth of your house, additionally the level of security you have inside it. Lenders often evaluate these factors to dictate what you can do to repay the borrowed funds. A top credit history, secure earnings, and you may lower financial obligation-to-earnings ratio can boost your odds of recognition.

Also, excessively guarantee of your property would be advantageous. Yet not, bringing accepted to possess a beneficial re-finance can be more difficult for individuals who keeps less than perfect credit, volatile income, highest loans, or little guarantee in your home. Irrespective of your position, it is usually a smart idea to remark your debts, talk about some lenders, and you will talk to home financing mentor to know the refinancing choice as well as the likelihood of approval.

How refinancing mortgage work

Like other version of refinancing, good cashout refi substitute a current mortgage with a new, big mortgage and directs the real difference to the borrower as the a good lump sum payment. These refinancing is perfect for people with high security in their property and so are interested in ways to finance large-ticket expenditures otherwise those seeking consolidate loans on the that down payment.

Advantages and disadvantages from mortgage refinancing

- You need cash. If you have accumulated significant equity of your home and want dollars to other purposes such renovations, using, otherwise financing studies, you might think scraping you to guarantee which have a funds-out re-finance.