Finding the right loan terminology, pricing, costs, and you can financial support time is going to be tricky no matter your credit score

Here’s how every one of these facets could affect your own borrowing feel-and the ways to allow you to get the best words having your loan.

Costs

Interest rates would be the greatest indication out-of financing cost, therefore researching the options is essential. You to device on your own repertoire are examining your Apr ahead of officially obtaining financing.

Many loan providers offer personalized rates which have a soft borrowing from the bank inquiry, that enables that examine cost instead of destroying your rating compliment of a challenging borrowing eliminate.

It is not the way it is for all loan providers, therefore see which kind of borrowing inquiry the financial institution really works just before submission your data. As well as, get ready in order to publish files, like pay stubs, to verify your data. Your own price otherwise approval you may change whether your financial are unable to ensure things.

Terms

It is well-known observe words private finance continue regarding several so you’re able to six decades. Should you get multiple alternatives with various repayment terminology, recall the entire cost of that loan vary according to research by the amount of your fees plan.

A longer identity function a lesser monthly payment, but you’ll spend so much more interest. The contrary is true for a shorter term.

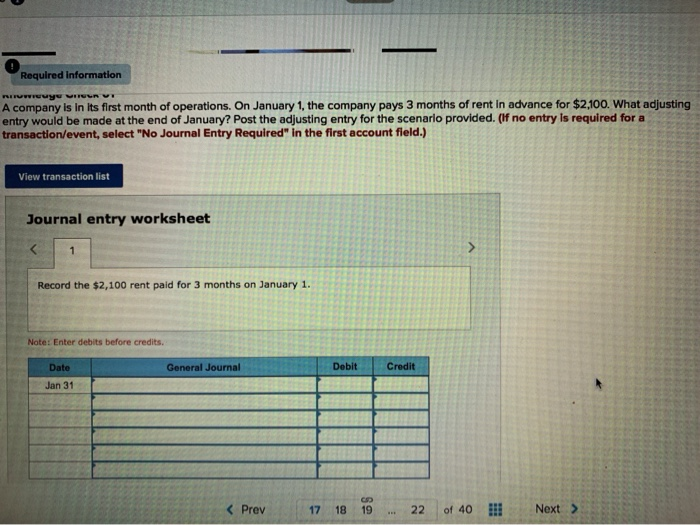

New desk lower than shows how financing terms impact the monthly installments and total desire costs having an effective $10,000 financing with an excellent % APR:

The main commission to own home improvement money was a single-date origination percentage. Origination charges can put on to every borrower, not merely individuals with poor credit (but your fee is higher according to your credit rating). The official in which you reside along with affects the origination percentage.

An origination commission can make the loan cheaper, but not. A lender giving a reduced interest rate you will charge increased origination fee to afford providers costs. Some loan providers use the fee out from the prominent harmony from the origination, and others include it with your repayments.

Customer ratings

In addition to, glance at if or not we keeps reviewed the organization. I search of numerous aspects of unsecured loans, plus just what users say, therefore we bring pride inside giving objective personal loan reviews therefore you can make the best choice for the cash.

Do it yourself loan application techniques

A lot of the present lenders give on the web programs you can done in the a short while. Even better, of a lot will perform a soft query, providing best regarding the matter you’ll qualify for and your rate in the place of extract their borrowing from the bank. Here is how it truly does work:

- Collect their proof earnings and you may term. Which have data files like your I.D. and you may shell out stubs able before applying could save you go out that assist you earn a choice quicker.

- Prequalify into lender’s website. Examining their pricing on the internet always just requires a few momemts. You’ll input guidance such as your name and target, and also the past four digits of the Public Safety number. It’s also possible to need county how much cash we should use and how you will use the loan.

- Pick a loan option. Your own bank get present you with more than one loan give. Thought for each and every a person’s cost who gets payday loans in Margaret? and you may terms and conditions, and make use of our very own fee calculator examine borrowing will cost you. When you’re ready, buy the alternative that best fits your position.

- Commit to a painful credit check. Prequalifying merely involves a soft pull, but when you propose to fill in a complete application, you’ll want to accept to a hard credit assessment one which just normally proceed.

- Give income and label verification. Contained in this action, you’ll offer much more comprehensive pointers, like your complete Societal Coverage number. you will publish the new data files your gathered in the past. This task is usually the longest action, depending on how of several records you will want to upload incase you have all of them protected electronically.