Exactly what Disqualifies a house of USDA Money Loans?

FAQ to own USDA Mortgage brokers

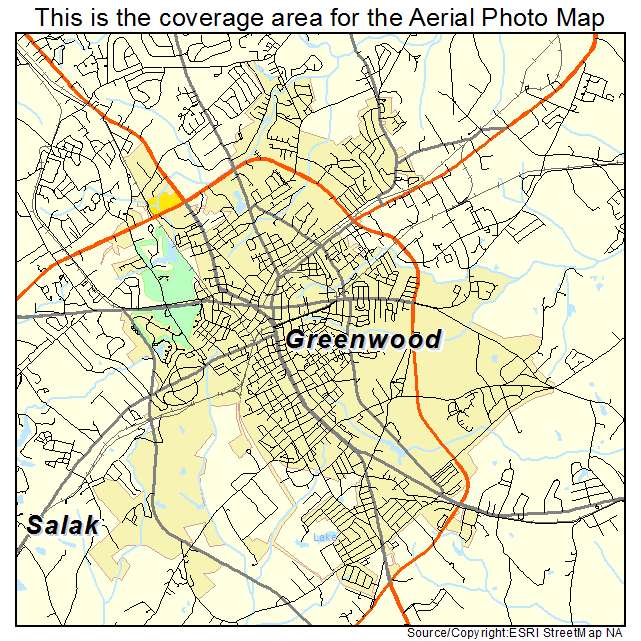

A button component that can also be disqualify property regarding good USDA mortgage are the place. Simply features from inside the eligible rural elements, since designated by the USDA, meet the requirements for it version of financing. In addition, the house must be used once the borrower’s number one house, not to have financing, farming, industrial, otherwise local rental objectives. It’s not precisely the the kind of domestic that has to meet USDA financial standards, the newest debtor might also want to qualify. Such as for instance, brand new borrower’s earnings need certainly to slip within the USDA’s earnings limits, and you can a minimum credit rating regarding 620 is normally necessary.

Exactly what Credit history Is necessary having USDA Home loan?

The credit rating to have USDA loan acceptance off acknowledged lenders varies depending on and therefore lender otherwise representative you are talking with. Usually, minimal credit history having USDA financing try 620, many financial institutions are searching for an excellent 640 otherwise 660 minimal fico scores. New RefiGuide will help you see the newest USDA mortgage criteria being be certain that you’re qualified to receive these types of rural capital system.

What’s the USDA Do-it-yourself Loan?

The latest USDA’s Solitary Family Houses Fix Loans and you may Offers system (Point 504) now offers financial help to own house improvements. It offers lower-attract, fixed-speed financing and you will grants in order to lowest-money outlying people to have very important household solutions, renovations, developments, and you will adjustment.

Which are the USDA Construction Loan Conditions?

An effective USDA build loan streamlines the home-building procedure because of the consolidating what you significantly less than a single mortgage. Which zero-off, low-notice mortgage is an excellent selection for lowest-to-moderate-income customers seeking create a home in the an outlying town. The brand new USDA build-to-permanent funds is actually a variety of you to-go out intimate home loan backed by the new USDA.

USDA-Approved Home loans

The fresh USDA and activities lenders straight to people who have the ideal financial you need or any other demands. Because of this the family need to meet up with the following criteria:

- There is no need a secure, decent or hygienic spot to live

- You simply can’t get home financing regarding a normal financial

- You have got an altered earnings that’s beneath the low-earnings restriction near you

USDA will usually give you a primary mortgage for a beneficial home with 1800 sqft or faster, in accordance with a market really worth in financing limit on the area. These types of numbers may vary dependent the space. A beneficial USDA home loan would-be $500,000 or more within the Ca, and as low because $100,000 for the areas of the fresh outlying United states. The government also offers USDA- mortgage finance in order to certified borrowers and you will eligible features.

Homes that are not Eligible for USDA Financing

A major limitation for the system would be the fact most places dont qualify. Just be located in a rural area. But there are lots of residential district portion one to also.

How-to Submit an application for USDA Home loan

To apply for USDA financial you will want to correspond with an effective recognized USDA outlying home loan company now. Remember that its not necessary be effective inside one variety of world to help you be eligible for an outlying financial regarding the fresh USDA. There are even financing to own an initial-go out family buyer which have poor credit, should your debtor match the brand new USDA loan qualifications requirements.

Individuals with a lesser earnings and a diminished credit rating must look into protected financing. You can get an extremely low interest and zero off, 100% capital in some instances. Just be sure that you’re considering property that may be eligible for an excellent USDA financing system. Speak to your real estate agent and have your ex just show you functions that may be eligible for a great USDA rural financing.