Better unsecured personal line of credit: KeyBank

When you have regular credit needs that can’t end up being protected by a charge card however, aren’t sure exactly how much required for an expression financing, a flexible credit line could be the account your.

Score Personal loan Cost

When you have normal borrowing from the bank means that can’t become included in credit cards, however, are not yes how much needed for a phrase loan, an adaptable credit line may be the answer for your.

The trick will be to decide which banking companies give private outlines of credit. Whenever you are you can find loan providers across the country offering private lines off credit, specific large organizations, such as for example Wells Fargo, don’t offer this service.

In order to get the best credit lines to have your position, we’ve got opposed over a dozen ones and chosen the three preferred. Read on to see why we selected these types of due to the fact top credit line providers available, as well as specific information on just how these obligations works.

- Best unsecured credit line: KeyBank

- Finest covered personal line of credit: Countries Bank

- Finest credit line to possess bad credit: PenFed

- Overview of our very own finest picks

- What is actually a personal line of credit? Here are the information

- Getting a line of credit

- Benefits and drawbacks off personal lines of credit

- Personal line of credit qualification and you can prices

- The best place to shop for a line of credit

- Our very own methods

KeyBank provides a somewhat strict set of cost because of its important unsecured personal line of credit, starting from % – %. While you are KeyBank’s is not always the lowest unsecured speed given, KeyBank’s indexed % higher maximum could help unsecured consumers that have average fico scores present a reasonable roof on their interest rates, so it’s one of the best credit lines inside the our viewpoint.

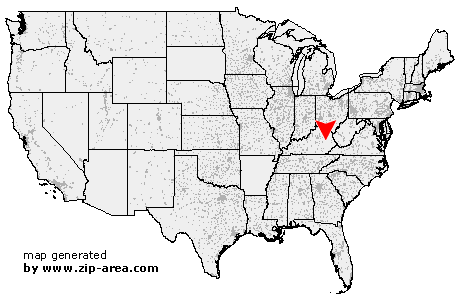

In addition, KeyBank has the benefit of an unsecured small-money line of credit for $5,000. To make use of which have KeyBank, you should open a merchant account into lender and you will live close a part within the pursuing the states: Alaska, Texas, Connecticut, Idaho, Indiana, Massachusetts, Maine, Michigan, New york, Kansas, Oregon, Pennsylvania, Utah, Vermont or Washington.

Unsecured credit lines won’t supply the low prices readily available, however they are a good idea having individuals which have strong borrowing from the bank users just who run out of equity. Borrowers who aren’t in a position to meet the requirements on their own can also see a great cosigner or co-candidate.

Drawbacks: Like many local banking companies, KeyBank is not widely accessible to all interested applicants. In the event that KeyBank proves to not become an option for you (geographically if not), check the other solutions lower than.

Best secure personal line of credit: Regions Lender

Places Financial are our very own finest get a hold of to discover the best low-home-equity safeguarded line of credit seller for its lowest APRs, versatile conditions and you may broad entry to. The lender contains the tightest Apr directory of any covered line out-of borrowing from the bank provider – anywhere between seven.5% and you can 8.5% – therefore makes you replace the line of credit annually, without limitations on the level of renewals.

Shielded lines of credit is unsealed with as little as $250 or to you might be willing to deposit in the account (up to a maximum of $100,000). You additionally have the option of securing their personal line of credit having a regions Computer game membership, savings account otherwise money industry membership; rather, it even lets apps out-of non-You.S. owners. Places in addition to keeps accreditation on Bbb.

A protected credit line is an excellent selection for borrowers that have imperfections on the credit details. Permits consumers so you can secure low interest on the lines out of credit and increase their odds of approval. not, lenders get the ability to repossess the newest security, should you fail to shell out your debts.