What’s PMI of course, if Must i Shell out PMI?

If one makes a down-payment out of less than 20% once you purchase property, lenders generally need to have the debtor to order personal mortgage insurance rates, and that is also known as PMI. PMI is insurance policies up against losings regarding home loan default wanted to the fresh lender from the a private insurance provider. In other words, new debtor pays for plans you to definitely covers the lending company should https://paydayloanalabama.com/morrison-crossroads/ you never spend your own mortgage. Please note one PMI doesn’t manage the debtor for those who don’t pay your own mortgage or get rid of your house to help you property foreclosure. PMI usually necessitates the borrower to blow a continuous fee every month once you make your mortgage payment or a single-go out upfront payment, that’s relatively unusual.

The fresh new borrower is just necessary to spend PMI so long as the borrowed funds-to-worthy of (LTV) proportion was more than the latest lender’s limit LTV endurance which is 75% – 80%, dependent on when you make cancellation request incase your own cancellation consult is founded on their unique value of at day your mortgage signed otherwise your property value. New LTV proportion signifies the fresh new proportion of your mortgage total the fresh new fair market value of the property in fact it is inversely relevant toward deposit new debtor renders. Such as, in case your borrower helps make good 5.0% deposit, the fresh new LTV ratio is actually 95.0% of course the fresh borrower can make an effective 15.0% down payment the new LTV proportion is 85.0%. The newest LTV ratio reduces since the borrower will pay on the home loan equilibrium throughout the years or if perhaps the house or property really worth increases. The new debtor can be demand to have the PMI fee cancelled when he or she believes the brand new LTV ratio is actually underneath the limit endurance.

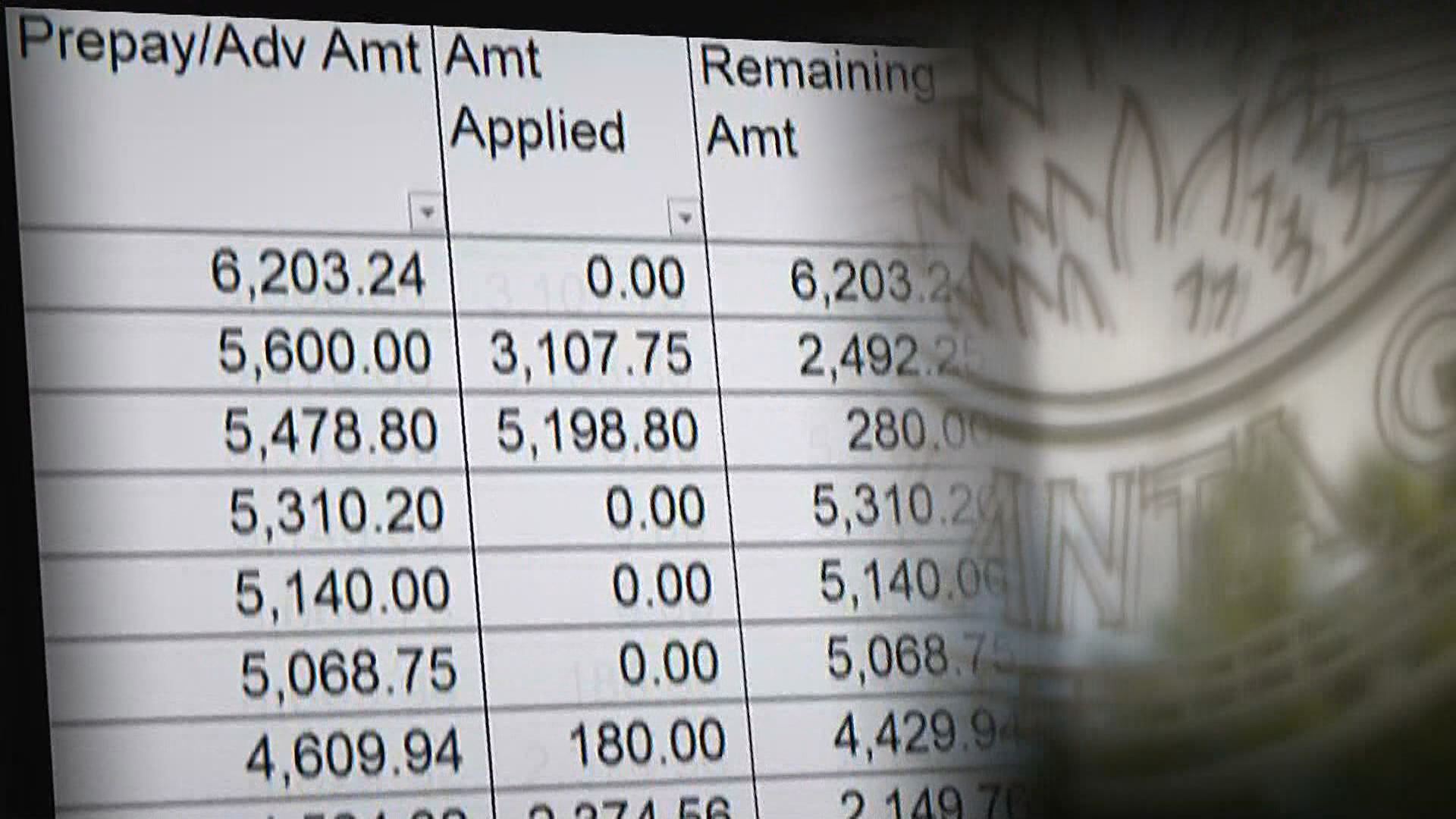

New dining table helps guide you ongoing PMI charges are very different of the LTV proportion and you may credit score having highest credit scores minimizing LTV rates having all the way down PMI rates

- Play with ourDOWN Commission CALCULATORto determine the fresh new LTV ratio according to their down-payment

The latest table shows you how lingering PMI charges differ because of the LTV proportion and you can credit score that have large credit scores minimizing LTV rates with all the way down PMI rates

- Loan-to-Really worth (LTV) Ratio: the greater the brand new LTV ratio, the better the brand new PMI commission

- Credit rating: the higher your credit rating, the lower the newest PMI fee

- Home loan Title: the latest less the borrowed funds identity, the low the newest PMI payment

- Home loan Type: repaired rate mortgage loans provides straight down PMI charges than other mortgage loans particularly since varying rates mortgage loans (ARM)

- Mortgage Count: the new PMI commission is high for home loan amounts greater than $650,000

- Cash-Aside Refinancing: you will find an additional PMI fee to have a funds-out refinancing

- Investment property / Next Domestic: there was an extra PMI fee whether your possessions being money try an investment property otherwise next family

If you find yourself needed to spend PMI, consumers usually find the constant fee choice, which is a supplementary monthly payment towards the top of your financial commission. Having a traditional loan, for those who We towards the a continuing month-to-month base, you do not pay a-one-time upfront PMI commission. Since the detail by detail regarding dining table below, the ongoing PMI commission depends on of a lot factors including your borrowing rating and you can LTV proportion. It’s important to stress that constant PMI depends on the home loan balance at the beginning of the year, perhaps not their original amount borrowed, that it declines over time as you reduce your loan.

New desk lower than suggests the fresh constant PMI charges to possess a thirty seasons fixed rates home loan, due to the fact a portion of your own loan amount. Particularly, with regards to the PMI cost table below, a borrower having a great 700 credit rating and you can 97% LTV ratio will pay a continuous PMI percentage away from .99% of your loan amount. if for example the mortgage harmony is actually $one hundred,000 as well as the lingering PMI fee was .99%, in that case your monthly PMI fee is actually $ ($one hundred,100 * step one.115% = $990 / one year = $ a month).

Take note your dining table less than suggests the new constant PMI charge for a 30 12 months repaired rate home loan during the restriction publicity peak. The PMI commission was high to have changeable rate mortgages (ARMs) even though a mortgage with an intention rate that doesn’t to alter for the first five years is considered a predetermined speed mortgage for the purpose of figuring PMI (thus a beneficial 5/step one and 10/step one Case are believed fixed mortgage loans). The desired constant PMI payment is also straight down getting mortgages that have regards to 2 decades otherwise less.

Ultimately, you will find additional coverage levels for PMI, or exactly how much of your own home loan are protected by the insurance coverage. For example, to possess a home loan with an LTV proportion anywhere between % and you can % you can purchase PMI which takes care of 18%, 25% and you may thirty-five% of mortgage harmony. The amount of coverage needed depends on the fresh new LTV proportion, financial system and you may financial coverage. Really loan providers and mortgage applications need maximum PMI publicity profile and this was 35% of loan amount (getting LTV rates ranging from % and you may %), 30% of your own amount borrowed (to have LTV proportion anywhere between % and you can %), 25% of your loan amount (for LTV ratio ranging from % and you will %) and several% of loan amount (LTV ratio between % and you will %). Certain apps want all the way down publicity account and therefore decreases the PMI commission. The newest table less than suggests the brand new PMI percentage just like the a share away from the borrowed funds number in accordance with the limit needed visibility profile.

The latest table demonstrates how lingering PMI charges are very different because of the LTV ratio and you will credit rating with higher credit scores minimizing LTV rates which have straight down PMI prices

- PMI charge are different financial and you may bank. Delight consult with your bank to select the PMI costs you to pertain towards the financial