Just how do Personal loans Really works? [While the Ideal and Worst The way you use Them]

We would found compensation regarding products and services mentioned from inside the that it story, however the feedback is the author’s ownpensation get feeling where also offers are available. I have perhaps not provided all the available circumstances or also offers. Find out about how exactly we make money and you will the editorial procedures.

Centered on present investigation of Experian, 22% out of American grownups keeps an unsecured loan and you will carry the typical balance of $sixteen,458. Customers use these financing to cover unanticipated expenditures, combine loans, financing family renovations, and a lot more.

Unsecured loans will likely be an appealing choice employing independence and apparently low interest. Still, they could not be the best solution for everybody, therefore it is essential to know the way signature loans functions before you signal their title into the dotted line.

- Just how can unsecured loans performs?

- 8 how can i play with an unsecured loan

- cuatro bad utilizing a personal loan

- What things to think since you go shopping for unsecured loans

- Options so you’re able to personal loans

- The conclusion

Just how do unsecured loans work?

Personal loans can be used for any sort of mission unless the mortgage explicitly claims the manner in which you need to make use of the money. He could be a kind of payment financing, so that you borrow an appartment amount of money and pay back the mortgage more than a predetermined level of costs, or payments. Also, they are generally an unsecured loan, and thus they aren’t backed by equity, such as your household or vehicle.

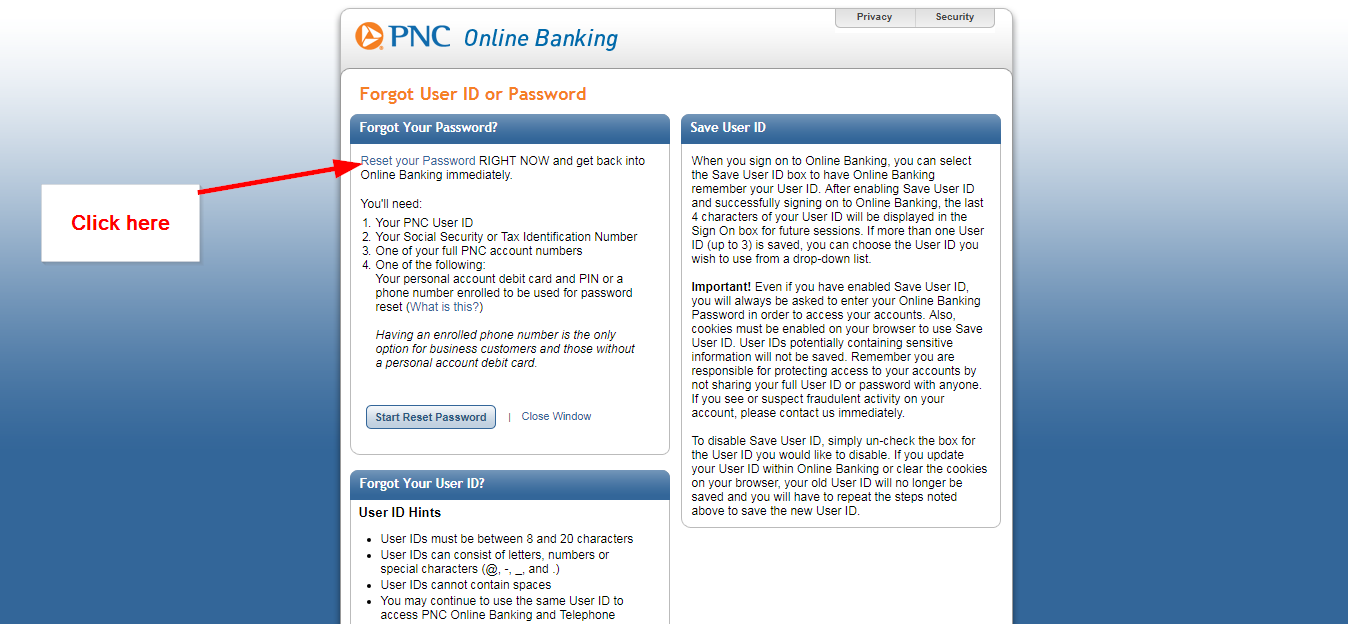

You might submit an application for personal loans from the banking companies, borrowing unions, and online lenders. What kind of cash you could use differs from financial to help you lender, but since you comparison shop, you will likely discover financing also offers somewhere between $step 1,five hundred and you may $a hundred,100000.

That have a keen unsecured consumer loan, the borrowed funds matter and you can annual percentage rate you qualify for try tend to predicated on your own borrowing from the bank character, that has your income, credit rating, and you can credit history, certainly one of additional factors. Usually, the higher your credit score, the more advantageous the interest rate you likely will found.

Personal loans are apt to have repaired interest rates, for example the interest rate continues to be the exact same along side lifestyle of the financing. When it is predictability you are once, a predetermined-speed financing may be the path to take. In comparison, variable-price money have straight down interest levels, although rates have a tendency to vary into business. Variable-rate signature loans try less common than simply repaired-speed alternatives.

8 how can i fool around with a personal bank loan

Consumers explore unsecured loans for many reasons, however, like most financial unit, it is best to utilize him or her only when it makes sense. Plus, make sure to can afford the brand new monthly payment monthly in advance of you move forward.

https://cashadvancecompass.com/loans/payday-loans-with-no-checking-account/

Whenever you are wanting to know whether an unsecured loan is reasonable to suit your condition, check out of the very most popular reasons to get a good unsecured loan:

1. Debt consolidation reduction

When you yourself have good to advanced borrowing, personal loans you certainly will allows you to spend less if you are paying of large interest rate financial obligation which have a low-focus mortgage. As an example, you might use your loan continues to pay off large-appeal personal credit card debt immediately after which pay-off your own all the way down-attract personal bank loan through the years. Which have straight down attention will cost you, you may be able to get regarding debt faster.

dos. Household restorations

Unsecured loans you certainly will offer residents an approach to improve their houses by within the cost of do-it-yourself methods. Of a lot consumers prefer unsecured loans more house collateral funds otherwise household collateral personal lines of credit as they generally don’t require you to definitely make use of domestic due to the fact guarantee.

3. Emergency expenditures

A consumer loan may potentially promote greeting rescue when lives sets your an economic curveball. Like, while you are quickly faced with unforeseen scientific bills or funeral can cost you, a personal loan could help without having sufficient readily available fund in your disaster finance. Once more, just make sure you really can afford the latest monthly financing commission thus you’re not struggling economically.